Article

Corporate Rebranding Process: Shawcor

A strong brand inspires belief not only among a firm's customers but also its investors. Companies with strong brands obtain stronger financial results by reducing cash-flow volatility and customer churn. Strong brands also help companies expand markets by facilitating new product trials, improving customer retention and cross-selling.

A large-scale study¹ compared the stock-price performance of companies with strong brands to a benchmark group by asking: how would $100,000 invested in each group grow over a period of time? $100,000 invested in companies with the 111 brands on the “World’s Most Valuable Brand” list grew to $452,500 over a six-year period compared to the benchmark group, which increased to $319,500. This represents a 41.6% gain for the “World’s Most Valuable Brands” relative to the benchmark.

Branding in Multidivisional B2B Firms

To build a successful and trusted brand, firms must identify strategic areas that are most important and act on this insight. Differences among customers should be accounted for in a firm’s brand development, deployment

This presents unique challenges for B2B companies. Especially those with a multi-divisional structure, because they offer complex value propositions to customers that aren't easy to quantify. Different divisions have different products, with different value propositions, for customers in different parts of the world. All this complicates the development of a unified, coherent and implementable brand positioning.

Case Study: Shawcor

We recently worked with a client confronting these exact issues. Shawcor is an integrated pipeline services company serving upstream, midstream and downstream companies in the oil and gas industry. It has a market cap of $2 billion, with four different divisions serving customers in all parts of the world. The divisions offer stand-alone products and services that are used by many of the same clients and in large-scale projects.

We used a data-driven approach to understand Shawcor's customer needs as inputs to developing a strategic approach to branding.

Brand Re-Calibration at Shawcor

As a starting point, we performed a competitive assessment of Shawcor and its competitors that revealed the following insights:

- Shawcor was positioning itself as the leader in terms of integrity. From a branding perspective, integrity was viewed to be part of the company’s values in multiple ways:

- Product quality as reflected in superior performance and durability

- Company ethics through compliance and integrity

- Focus on safety as in integrity of systems, safer products, and processes that preserve product and project integrity

- Much of this focus was driven by technical innovation and was reflected in a premium-pricing approach

- Shawcor's two largest competitors focused on the safety, strength

and assurance of their products and services. Both competitors were immature digitally with no real acquisition strategy online. Innovation and technology seem to be key themes within the strategy of both companies, and both competitors were more diversified than Shawcor regarding industry and product use. - Shawcor grew by adding product lines and acquiring smaller companies. As competitors grew their offerings, there was a need to re-evaluate the branding approach used by Shawcor.

Data-Driven Approach to Brand Re-Calibration

To determine Shawcor's branding from a customer perspective, we conducted a survey of its customers to address three specific issues:

- Establish the relative importance of key strategic areas as determinants of customer-based brand equity

- Identify specific execution levers for the most important strategic areas

- Supplement its key account management strategy, describe how people at different levels in client organizations perceive the value proposition

We used a multi-stage approach as outlined below.

Stage 1

Measure Strategic Areas and Execution

The interview insights helped formulate a customer survey developed in conjunction with the client and data-science advisory team. The survey used industry best practices to capture the voice of the customer².

The voice-of-the-customer methodology ensures accurate measurement and benchmarking of the following key strategic areas:

- Innovation/R&D

- Customer Solutions & Performance

- Teamwork & Partnership

- Communication

- Safety/Reliability

- Project Management

Stage 2

Multivariate Statistical Modeling: We collaborated with our data science advisory team that used a multivariate statistical approach answer three specific questions of interest to Shawcor.

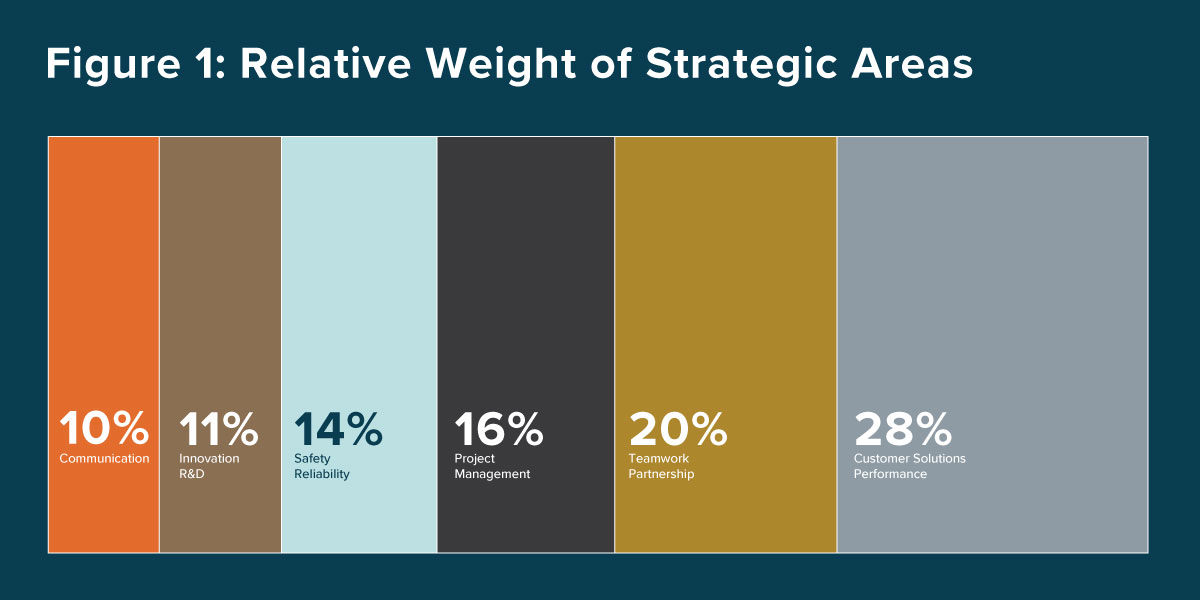

Question 1: What is the relative weight of different strategic areas in describing customer-based brand equity?

Answer: As shown in Figure 1, the quantitative analysis revealed new insights that were not apparent to Shawcor's executives. Within the total value proposition, 64% of the value was driven by Customer Solutions & Performance (28%), Teamwork & Partnership (20%), and Project Management (16%).

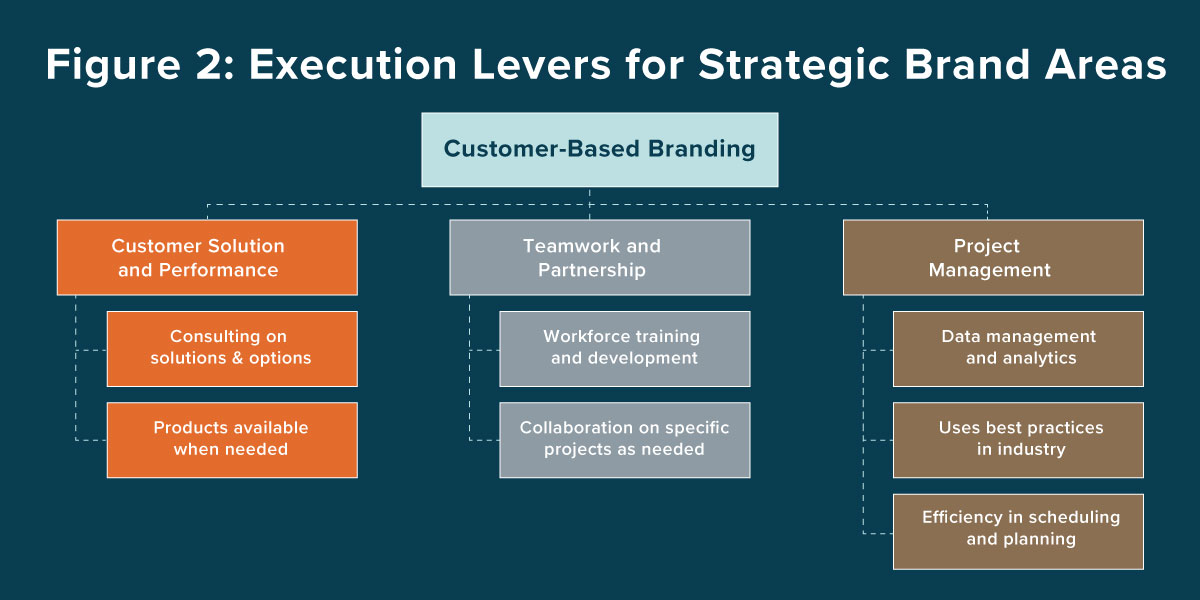

Question 2: What execution levers can improve performance in the most important strategic areas?

Answer: As shown in Figure 2, within each strategic area, the multivariate analysis identified execution levers that were the focus of different functional areas. The execution levers represent specific activities that would be the most influential in improving performance for each strategic area.

These levers provided the implementation blueprint for Shawcor's management team.

Question 3: How is the brand value perceived by people at different levels in client organizations?

Answer: As shown in Figure 3, the results show that the value drivers are different for

- “Teamwork & Partnership” along with “Project Management” drive brand value for those at the Director/VP/SVP/CEO level

- “Customer Service / Performance” drives value for those at the Manager/Supervisor level

- Those at the analyst level see the most value in “Communication” and “Safety/Reliability”

Within the same client organization, Shawcor could emphasize different value drivers when interacting with different people.

These were important insights for helping Shawcor develop its branding strategy to reinforce these value drivers.

Next Steps

The results were presented to Shawcor's top executives, who collaborated with us to execute its rebranding approach.

The results were then shared with the sales organization at its annual conference. Shawcor's salespeople found our guidance very useful when interacting with customers.

The firm is planning to integrate the customer study into its annual strategic planning process for actionable insights.

Contact our President and CEO, Bo Bothe to discover how we implement a data-science method to examine every aspect of our clients.

Resource Citations

[1] Madden, Thomas J., Frank Fehle, and Susan Fournier. "Brands matter: An empirical demonstration of the creation of shareholder value through branding." Journal of the Academy of Marketing Science 34, no. 2 (2006): 224-235.

[2] Mittal, Vikas, The Voice of the Customer: A User's Guide to Customer Surveys (February 1, 2017). Available at SSRN: https://ssrn.com/abstract=2909989