Podcast

Why is Brand Research Important?

Why is Brand Research Important?

*This transcript has been edited and formatted for readability.

Chris: Today, we’re going to talk about the importance and value of brand research. To help me tackle this topic, I’m joined by President and CEO, Bo Bothe; Chairman, Jonathan Fisher; and Data Science Advisor from Rice University, Dr. Vikas Mittal.

In preparation for this episode, we realized that we have a fantastic example to guide us through the topic of the importance of brand research.

This is one of our projects: a local adoption agency here in Houston called Arms Wide Adoption Services, formerly Spaulding for Children.

Last year, they came to us asking for help articulating the strategic goals of their organization. As we worked through our research process, it became clear that they actually needed a rebrand.

This is a high-level example of what brand research and brand analysis can do and uncover.

What Is the Value of Brand Research?

Chris: I’d like to start by discussing why brand research is so important. What’s the value of brand research?

Jonathan: When you go into conducting brand research, if the assumption is that your client knows exactly what they need, chances are there’s going to be some oversights, gaps, missed opportunities and things that could be leveraged.

When we conduct brand research, we go in as broad as we possibly can to vet and validate what the client is asking for. One of the critical pieces to brand research is being open to the possibilities that you can uncover, including insights into brand awareness.

The Relationship Between Qualitative and Quantitative Brand Equity Research

Chris: There’s quantitative and qualitative research. Can you talk about what role each plays in this process?

Vikas: Qualitative and quantitative research are your right and left. A lot of companies make the big mistake of thinking that, somehow, one is a replacement for the other.

Qualitative and Quantitative Research Example

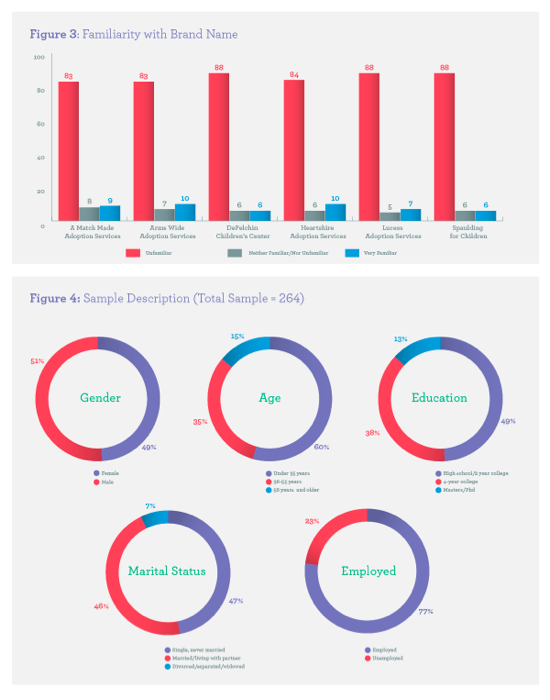

Vikas: The project Chris mentioned is a perfect example of using both types of market research for the benefit of the ultimate goal of brand research. Arms Wide Adoption knew that the name Spaulding was being confused with the basketball company, which caused some brand recognition issues. The employees had some ideas, the management had other ideas and, of course, the clients had some other ideas.

The qualitative research was done using in-depth interviews.

We sat down with each of those three constituencies in focus groups and asked them what the issues are:

- The name is confusing so what would be some alternative names that you would desire?

- What are some of the properties in those names that you would like?

- What does the brand evoke for you?

- What is the ethos of the brand?

- We gathered all of this information through qualitative research. Once we had it, we needed to determine the interrelationship among these.

It was good to know that we had three possible names, but we didn’t know what percent of people liked each brand identity. That’s where the quantitative research stepped in.

We did a national random sample and we fielded the different associations with the names and gathered quantitative data through online surveys and other market research. From there, we were able to paint a very clear picture for the client. Interestingly, there are a lot of companies that jump right into running surveys without the qualitative insights in hand.

In this case, the client asked, “We really like the Arms Wide name. What kind of ethos does it present?” Because we had the qualitative data, we were able to go back to the focus group interviews and give good insights to the client.

In addition, the huge benefit of conducting qualitative research is that you really get to talk to a lot of people and build bridges, and that helps with the implementation phase. People have bought into the idea, they’re more familiar, they don’t see it as a threat and they have a degree of ownership.

The Value of The Qualitative and Quantitative Data

Chris: It seems like that is almost a brainstorming part of trying to hash out feelings and such.

Bo: That's a big part of what we've done as branding experts. Qualitative research has always been valuable to us as it informs us of how people feel. You can see it and feel it as opposed to research that gives you data.

When you combine its results with quantitative research, it makes it a lot easier to develop a name, come up with the ethos for the brand, the way it should look and feel and the way somebody is going to interact with it.

We have been working together on the quantitative piece, taking the qualitative insights and making them real for the customer. When you do qualitative research, you have a gut feel for what seems important to the brand, but you don’t know the degree to which those things are important. You don’t know what “fun,” “faster” or “safe” really mean to the brand until you add the quantitative part to it.

When you add that depth of brand research, on top of the fact that it is repeatable, – I can ask the same question several times to get more feedback – you start to really understand the depth and the importance of the different variables or attributes of a brand.

Combining Qualitative and Quantitative Data

Chris: It sounds like you use this qualitative research methodology – and we’ll talk a little bit about the process later – to pull these ideas and then the quantitative is about solidifying them by putting the numbers behind the reasoning. Is that accurate?

Vikas: The qualitative research answers two very important questions: “What?” and “Why?” For example, “What are the core issues? Why are these the core issues?”

Then, quantitative research can further take those and answer “What percent of people think this is a core issue? What are the interrelationships between these issues?” That’s the nice thing about using both of them to create a project in terms of branding.

Chris: Once we have this data, it’s our job to express it and create something that’s going to speak to those concerns that came out in the research.

Understanding the Gaps with Qualitative and Quantitative Data

Jonathan: Different target audiences are going to have different weighting to what is their number one issue versus their number two issue. But is that weighting two degrees apart or is it 50 degrees apart? That’s not something you’re going to get from the qualitative process. So, in the quantitative process, the insights come from understanding that gap and that variability.

Bo: We’ve always told our clients about the importance of these methods, as many of them don’t have the desire, discipline and maybe budget to get deep quantitative.

The problem with that is, sure we can get them 80% there, but that other 20%… you don’t understand the depth of how much somebody needs a personal touch in this.

We’re talking about an adoption agency. The assumption is they want everybody to be touchy/feely, but this is serious. How deep are the different emotions there?

You’re talking to a really diverse group of people. They all have different opinions and thoughts on the process and they all vary on what scares, excites, worries and what makes them happy.

It would be easy to make some assumptions based solely on qualitative data obtained from conversations. The problem is you have to find those one or two things that people will grasp.

"Different target audiences are going to have different weighting to what is their number one issue versus their number two issue."

Brand Research Methods and Steps

Chris: The quantitative part allows you to think about what’s going to make the most impact with the most people. In this particular project, there were four distinct steps. The first step was the qualitative part; identifying the key issues and themes through qualitative research. What did that look like in this process?

Step 1: Qualitative Research - Identifying Key Issues and Brand Perceptions

Jonathan: There is an internal assessment by talking with staff to understand brand associations. We like to do a complete of any organization. If there are multiple locations, offices, departments, tiers, regions or international presence, you want to get a healthy of the organization.

This is going to engage the organization and it’s going to culturally align it. They’re going to buy into the stakeholder process, but you’re also going to get a healthy set of perspectives from the organization, top to bottom.

I think too many people make the mistake of trying to do this just within the C-suite. The truth is you have to be careful with this. Internal engagement is huge.

The Importance of Customer Engagement

Jonathan: Customer engagement is also a big piece of this, but people forget to look at it beyond existing customers. What about past customers? What about lost customers? What’s a good customer? What’s a bad customer? What is their perspective going to be like?

It is important to include the different types of prospects that are in the marketplace. You want that good external perspective as well.

Competitive Analysis and Market Research

Jonathan: Then, there’s often a competitive analysis factor. Understanding what the marketplace is doing and saying, how other people might be organizing their products, services, their value-added benefits, their claims, their warranties, their service promises… This also influences the survey design that you’re going to put together for the quantitative piece.

I like to think of this as a three-legged stool because if you take one leg off, you’re going to fall down.

Step 2: Distill Brand Perception Into Concepts

Chris: What's the next step once you've pulled out those ideas?

Bo: In this case, the research happened on the names, but you can also use research and data on the front end to capture information on the brand drivers or their values. That provides information to the creative or marketing team that’s developing the identity of the brand.

Out of these workshops and the information we gathered, we developed names, identities, thoughts and different kinds of solutions that could work. But we also give the research team the ability to go out and test these different pieces to see who was doing what, who responded to what and how they responded to each of the pieces.

Evaluating Brand Perceptions

Bo: Brand perception is evaluated through both qualitative and quantitative research methods.

As branding experts, these are the professional considerations that we typically have on the creative and brand positioning side: How should this look, feel, sound? What is the positioning for that? How’s that going to work?

Then we figure out how to express it visually and verbally to design the test.

Chris: To be clear, this is still part of the qualitative phase of research, correct? Or, is it a setup of the quantitative research part?

Vikas: Step two basically takes all the information from the qualitative research and distills it into test concepts.

Chris: Like a hypothesis.

Vikas: It can be hypotheses. But in this case, the test concept worked with the five alternative names. We had the existing name of the organization, one or two competitor names, and two additional new names that we had thought of. That’s one concept.

The second thing we wanted to test was the brand positioning people have with each of these names. That is in terms of all the softer aspects of the names.

Then we wanted to get a sense of the likelihood of people approaching the agency based on the different name options, respectively. This was the second step where all the qualitative research was taken and tied back to what I call “actionability.”

Qualitative research usually looks like transcripts of interviews. The brand strategist has to go through all those transcripts, cull all of that information, and then create what we would call the testable solution kit. That’s step two.

Step 3: Quantitative Testing

Vikas: Step three is the quantitative testing. This is what Bo was talking about. You could do it through a hunch. “This kind of looks good. We feel that this will work,” or, “We think that it will have a good uptake.” But the difference here is that, with quantitative testing, we have rigor.

We can tell you, for example, “50% of the customers prefer this while 80% of the customers prefer that.” In this case, we compared the difference between the liking, usability and the uptake of the existing name versus the new name.

This sort of brand recall helps us understand the effectiveness of the new brand identity.

Now, whenever the brand strategist takes the recommendation back to the C-suite, backed with all of this data, their decision process becomes easier. In fact, that did happen. They looked at all the data and when Jonathan took it to them, they could actually see and understand what had happened.

So for the Arms Wide brand case, step two, was the linking pin between step one, which is qualitative research, and step three, which is quantitative research.

Quantitative Research Minimizes Risk

Jonathan: When you do that, you’re also reducing risk, which is a big factor. Whether it’s a product, service, corporate strategy or corporate name that you’re implementing, you want to minimize risk as much as possible. Risk costs you time, money and reputation. It can also cost you customer attrition.

It can destroy a lot of things that you’ve got in your strategic roadmap and it can derail it. We want to protect investment as much as possible. That’s where the deep benefits of the quantitative process come from.

Quantitative Research Increases Confidence

Bo: Most of my career seems to focus on the qualitative part. You show logos to people. You show them the brand market research you did to get to what you did, but then it becomes this subjective, decision-making piece.

When you add step three – the quantitative aspect Vikas was talking about – it gives them confidence that they’re making the right decision.

We’re professionals. The work we do will work. It’s well-informed, but when you put numbers and data behind it, it confirms the decision to make the change.

It addresses the brand equity issue where people lose or step back when we do this. Then, it allows them to have a substantive conversation about the decision, what works and what doesn’t, as opposed to what they like and what they don’t.

That is critical. We’ve always talked about it with our clients: adding the data is a critical component to the decision-making piece. It allows them to adopt this and run with it, as opposed to questioning themselves the entire time they’re trying to do it.

Quantitative Research Inform Brand Strategy

Jonathan: The data informs the overall brand strategy and reduces risk. I would like to be clear. There are multiple testing methodologies and there are multiple places to test any campaign or program: A/B testing, testing, consumer-focused group testing, but a lot of those are downstream in the process.

You’ve already committed to your creative campaign budget, your media spends, your product packaging, our service collateral systems, your websites, etc.

The testing we’re talking about is a much higher level and it’s earlier in the process. I think that’s where it really starts to have a cascading effect because the further downstream you test, the more investment, the longer the time, the greater the risk and the harder it is to rebuild the foundation of the house.

Vikas: Houston is a B2B town. People almost always talk about this idea, “Do you want lower initial costs or do you want a lower total cost of ownership?” If you can work the qualitative and quantitative together, in the long run, it really lowers the total cost of the branding exercise.

Bo talked about this idea of repeatability. For example, we already have server and baseline metrics for Arms Wide. After a year or so, if they wanted to know how much did the needle move, we’d be able to answer them.

We have done all this branding. We’ve invested in all kinds of things. How much did the needle move and what does this mean for a number of calls received?

We actually have the basis to do that investigation and give them high-quality feedback so they can adjust, not based on a hunch, but on everything that they have done to measure the results.

Chris: I’m glad you mentioned that because it tends to get lost in research. And it is valuable to have a benchmark to compare against. If you’re looking to achieve specific outcomes, you have to know where you started.

This type of research can tell you what your sentiment was for your initial brand as opposed to the new brand. In this case, it’s been obviously well-thought-out and well-received.

Step 4: Brand Finalization and Recommendations

Chris: Getting back to the steps, the final step is finalizing and recommending. It’s about interpreting the data and putting actual statements to what the data tells you.

Is there anything we need to consider in this step in terms of studying the research or is it coming out in black-and-white?

Vikas: In my experience, the biggest mistake a lot of people make in step four happens after they have done the quantitative research, and they have their bar graphs and pie charts. People get beholden to that and forget that those graphics must be interpreted in light of all the qualitative learning that went into creating them.

As much as I say this, few people do it. I always say before you sit down, to look at the quantitative results, go back and read the qualitative report. It’s that piece that really helps you understand the “Why?” It completes the picture.

Build Something with Brand Value

Bo: In step three, we talked about making this adoptable. The main thing that you want out of this process is something that not only works but that the organization and its audience can consume, buy into and be a part of.

That’s not just a data point. That’s the emotion around it. And these are the things that people miss when they don’t do both. When they don’t look at the qualitative and observe how people react to things, they miss a big part of it.

You must look at the data, take your biases out and think about what the numbers say. For instance, “How does that correlate to what we heard?” But you have to be able to put that emotion with the factual information as it allows people to buy in. It allows people to really get into what we’re doing.

Mind the Brand Gap

Jonathan: In this stage, one of the key things to discuss with the team, board or even third-party advisors, is whether there is anything in the data that we can’t support.

It might be the right claim to make, the right name, emphasis or attribute to focus on, a quality statement, an attribute that the customers highly value. So you see the executive team immediately jump on that and go, “Yeah, that’s us. That’s where we want to be.”

But then, when you go back and read the qualitative statements, what you realize is that there were all these gaps in the organization.

The critical statement that Vikas just made about going back and reading what was informing you and linking those pieces together, really connecting the dots, is the biggest discussion that has to happen. It’s not just a conclusion that the data is right and we should just implement it regardless.

You don’t want to be making these changes in your brand, position, statements, or service promises if you haven’t operationally been able to deliver on them in the past.

Just because they’re coming up now doesn’t mean you can support them. I think that’s an important piece to always focus on at this stage.

Remove the Ego: Your Brand's Success

Bo: These four steps are critical to getting something that’s adaptable, and that works for the organization. But there’s still that question - “Can it work? ”

Our own bias goes into this. The pitfalls and the challenges that you can encounter in this process are: looking strictly at the data or making decisions based solely on a hunch after the qualitative research.

It’s the combination of those two things. We have always had to take our own personal opinions out of things. Not our personal insights or our experiences, but you have to take a step back because you could make a mistake.

To Jonathan’s point about talking to leadership, the customer might expect you to be fast, but that doesn’t mean your organization can deliver fast.

Finding those things and taking your bias out to look at them with a clear mind, is really important, especially in this stage. But you must also do it when you’re at the beginning; take a step back and take a deep breath.

Vikas: This goes back to the idea that branding is not a communication exercise. It may start with communication, but at the end of the day, branding is actually an implementation exercise. Both at the strategic and the tactical level, and configuring your value chain to deliver.

That’s where a lot of companies make mistakes. They keep thinking that this will all be about a campaign.

Bo: It’s absolutely not that.

Brand Research Equals Brand Opportunities

Chris: We have these conversations with our clients and a lot of times they’ll come in and say, “Hey, we need refreshed messaging. We need a new look,“ and really it’s not about that.

It could be a catalyst for this change, so we need to get down there and find out what makes your brand and what makes it tick.

Bo: When you’re evaluating a brand, you’re evaluating the opportunities. That’s what you want to be open-minded about. Don’t go in with any assumptions.

You have to find the uniqueness in every organization. The goal of the brand is to differentiate. You have to find and capitalize on it. And you have to align that uniqueness with the marketplace so that it has relevance.

Chris: Well, guys, this has been great. Very insightful. Thank you for taking the time.

Get the Most Out of Your Brand's Value

Download our free guide, "How to Measure Your Brand's ROI," and discover how to accurately quantify your brand’s value and guide your strategic decisions.